Carbon capture and storage (CCS) and direct air capture (DAC) are different technologies for isolating CO2.

Humanity’s failure to reduce planet-warming carbon dioxide emissions — 41 billion metric tons by 2022 — has pushed once-marginal options for capping or reducing CO.2 of the atmosphere to center stage in climate policy and investment.

Carbon capture and storage (CCS) and direct air capture (DAC) are both complex industrial processes that isolate CO2 but these newly emerging technologies are fundamentally different and often integrated.

Here’s a primer on what they are and how they differ.

What is carbon capture?

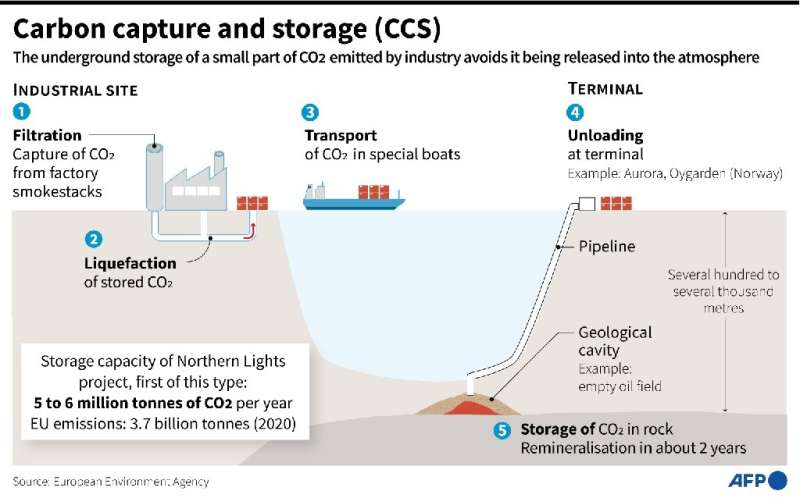

CCS captures CO2 from the exhaust, or flue gas, of fossil fuel-fired power plants as well as heavy industry.

The exhaust from a coal-fired power plant is about 12 percent CO2while in the production of steel and cement it is usually double that.

Unlike CCS, which itself only prevents more carbon dioxide from entering the atmosphere, DAC captures CO2 molecules are already there.

Essentially, this makes DAC a “negative emissions” technology.

So it would generate credits for companies seeking to offset their greenhouse gas output—but only if the captured CO2 permanently stored underground, such as in depleted oil and gas reservoirs or in saline aquifers.

The concentration of carbon dioxide in ambient air is only 420 parts per million (about 0.04 percent), so corralling the CO2 Using DAC is very energy intensive.

Carbon capture and storage (CCS).

Once isolated using CCS or DAC, CO2 can be used to make products such as building materials or “green” aviation fuel, although some of the CO2 seep back into the air.

“If the CO2 used, then it is not a removal,” said Oliver Geden, a senior fellow at the German Institute for International Security Affairs.

State of play

The fossil fuel industry has been using CCS since the 1970s but not to prevent CO2 from leaching into the atmosphere.

Instead, oil and gas companies inject CO2 to the oil fields to get crude oil more easily.

Historically, bolting CCS facilities to coal- and gas-fired power plants and then storing the CO2 to reduce emissions proved to be technically feasible but not economically feasible.

The world’s largest CCS plant, the Petra Nova facility in Texas, was mothballed three years after opening in 2017.

But the looming climate crisis and government subsidies have reignited interest in CCS for the power sector and beyond.

By the end of 2022, there will be 35 commercial facilities worldwide applying industrial carbon capture technology, fuel conversion or power generation, sequestering a total of 45 million tons ( Mt) in CO.2according to the International Energy Agency (IEA).

DAC, in contrast, is very innovative.

A total of 18 DAC plants around the world capture only roughly that much CO2 last year (10,000 tons) while the world released 10 seconds.

The Climeworks “direct air extraction” factory removes CO2 from the air.

Scaling up

Both CCS and DAC must be massively scaled up if they are to play a significant role in decarbonizing the global economy.

To meet the mid-century net-zero emissions target, CCS needs to divert 1.3 billion tons a year from power and industry—30 times more than last year—by 2030. , according to the IEA.

DAC must remove 60 Mt CO2 per year on that date, several thousand times more than today.

But the new industry is developing with new actors, and the first million-ton-year plant is scheduled to come on line in the United States next year, with others to follow.

“It’s a big challenge but it’s not new,” University of Wisconsin–Madison professor Gregory Nemet told AFP, citing other technologies, including solar panels, that are developing in many decades.

Prepare a stock CO site2 could take up to 10 years, so storage could be a serious bottleneck for CCS and DAC development.

Cost per ton

Carbon capture costs $15 to $20 per ton for industrial processes with large CO streams2and $40 to $120 per ton for more diluted gas streams, such as power generation.

DAC—in its infancy—has higher costs, ranging from $600 to $1,000 per ton of CO2 caught.

Those costs are expected to drop sharply to $100-$300 per ton by 2050, according to the inaugural State of Carbon Dioxide Removal report, published earlier this year.

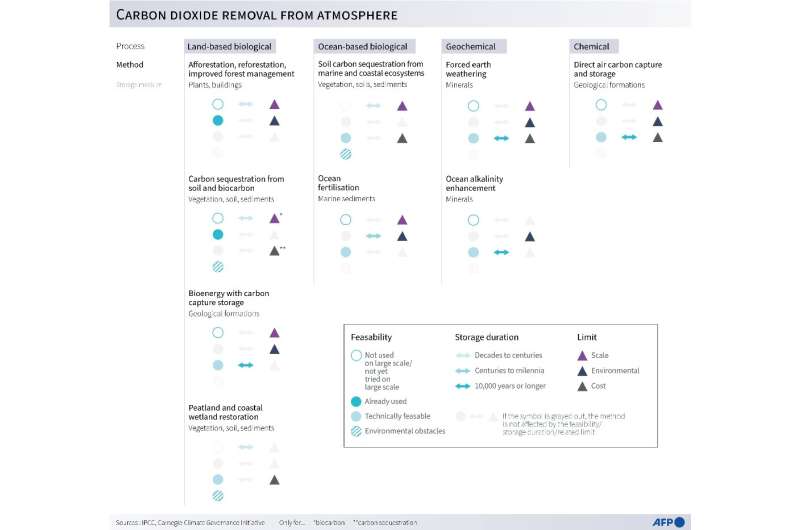

Removing carbon dioxide from the atmosphere.

Follow the money

As countries and companies feel the pinch from decarbonization timetables and net-zero commitments, more money—public and private—is flowing into CCS and DAC.

In the United States, the Inflation Reduction Act (IRA) allocates billions of dollars in tax credits for CCS.

The previous Infrastructure Investment and Jobs Act provided about $12 billion over five years.

Canada’s 2022 budget also extends an investment tax credit that cuts the cost of CCS projects in half.

South Korea and China are also investing heavily in the sector, with China opening a 500,000 Mt plant last month in Jiangsu Province.

In Europe, support comes at the national level and is focused on industry and storage, especially in the North Sea.

For the DAC, a range of companies — Alphabet, Shopify, Meta, Stripe, Microsoft and H&M Group — paid into a fund with a promise to collectively purchase at least $1 billion in “permanent carbon removal” between 2022 and 200.

Last month, JP Morgan secured a $20 million, nine-year carbon removal deal with DAC pioneer Climeworks, based in Switzerland.

© 2023 AFP

Citation: Carbon ‘capture’ climate tech booming, and confusing (2023, July 4) retrieved 4 July 2023 from https://phys.org/news/2023-07-carbon-capture-climate-tech-booming .html

This document is subject to copyright. Except for any fair dealing for the purpose of private study or research, no part may be reproduced without written permission. Content is provided for informational purposes only.